ICOs, Security Tokens and Public Offering Regulations

This post was published on our Medium channel. To read the full post, please click here.

Crypto industry moves so quickly that it seems like years ago when the ICOs were the cool kid on the block. Everybody was talking about or doing something in the ICO space. You had an idea that needed funding — ICO was the answer. This was literally the case less than six months ago. Sure, there were clear signs of cooling off, but still — six months and the market has completely changed.

Now, if someone says they’re going to do an ICO, you can hear the voice in your head going “oh man, it’s not gonna succeed, this train has left the station”. And most likely, this voice is right. ICO project has to be exceptional to gain any interest at all. Forget about raising tens of millions. Funds don’t want to hear anything about ICOs. Retail investors have lost enough and escaped the market. Ideas, that would’ve raised 100m € one year ago, are failing to raise a petty 1 million € today via ICO.

Why? Well, there are many reasons. Scams and weak projects that will never release or never planned to release a product. Or, look at the price action of almost every ICO token. The price peaks during or shortly after the token is listed on an exchange as whales manipulate the price, create the demand by bumping it up, the fomo squad jumps in to get their piece of the gains, as whales exit and register their profits. The fake demand is gone, price plummets — there’s no liquidity, demand, nothing. The retail investor that just got screwed isn’t very smart or just does not understand the game well enough. It’s hard to believe the level of manipulation of the crypto markets, unless you actually have seen it and know it for a fact. We’ve talked to a few post-ICO token price management companies (yes, this is how they call themselves). The so-called whales. The price action described above is how they operate and it’s their whole business model. However, this is not why I made the statement that the retail investor isn’t very smart. They just didn’t know the dynamics of this early and wild ICO market. This statement was made because of the unreal expectations and poor due diligence.

Think about it. It’s unreal to expect to get 10x returns few days after the investment, or in one month, or two months after the investment. What drives that value? Companies issuing the tokens are usually startups, and startups need time to build their products. Building a decentralized product is way harder than building a centralized product, and building a good centralized product is not done in 1–2 months either. Hence, the expectations were unrealistic to start with.

The second problem is the due diligence. Making an investment requires thorough due diligence and understanding of the project. VCs see thousands of projects per year and invest only into a handful. It’s because most projects aren’t worth investing in. As the times were good and crypto prices were rising rapidly, all decisions seemed to be good decisions. Unfortunately, most of the bad decisions are done in good times. Bad investments into poor assets bring economic downturn, and in crypto markets, it just happened quicker than in traditional markets. Difficult times require good decisions and careful analysis of where to deploy capital. Hence, the level of analysis and decision-making has improved. Better projects get funded. This creates a better and more stable crypto market.

Yet, even with a better due diligence and better quality of the projects, ICO as a fundraising method is a lot less interesting for an investor than before. It’s because there’s a new cool kid on the block. And this one is here to stay.

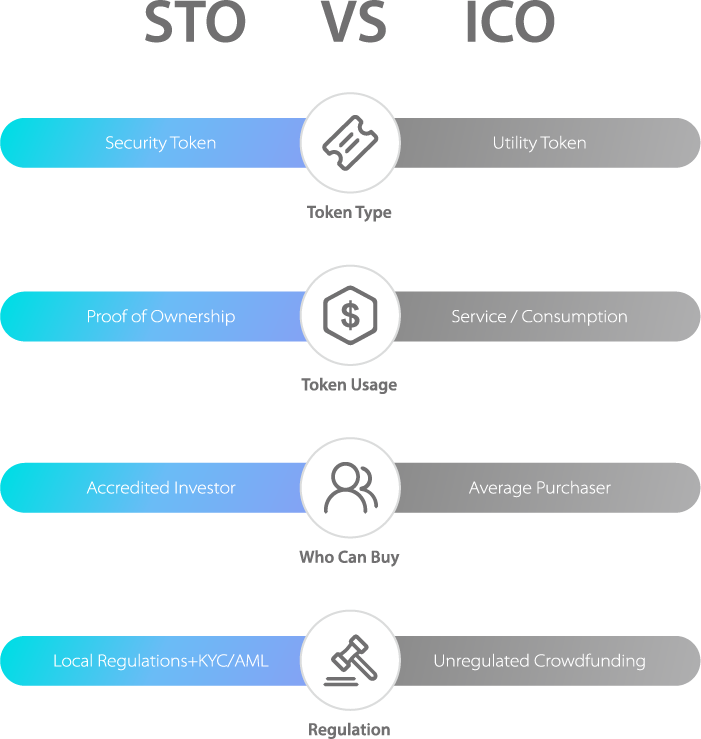

Of course, we’re talking about the security tokens.