How to Add an Accountant to Your Estonian Company with Your e-Residency Card – 2021 Tutorial

All Estonian companies need to do accounting. In this tutorial we will show you a step by step guide on how you can add an accountant to your Estonian company using your e-Residency card. This is not a complicated process and won’t take more than 10 minutes of your time.

Before you get started, ask your accountant to provide you a social security number or a tax office user ID. You will need that once you have to enter the details of your accountant.

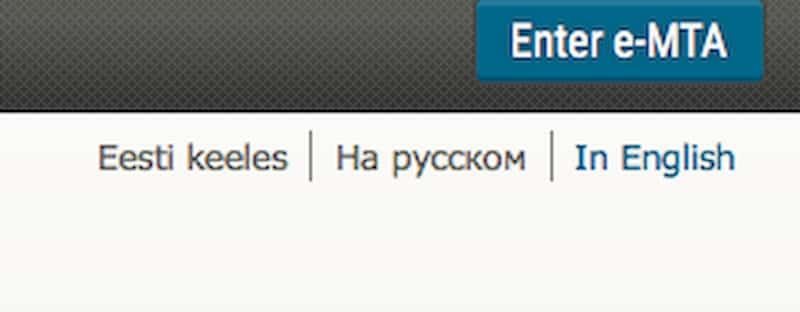

Step 1. Go to the e-tax office.

Once you arrive at the tax office website, navigate to the top right-hand corner of the page, choose English language, and click the Login button.

After clicking on the “Enter e-MTA” button, the next page you will see is the one where you have to choose the method of identification. ID-Card is the option for you, and if you happen to have a Smart-ID, you can choose that one as well.

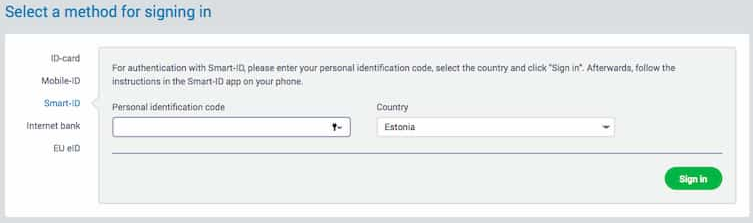

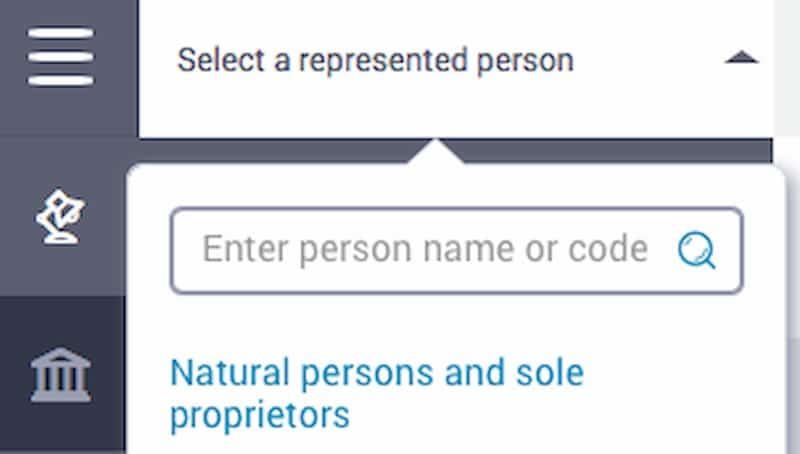

STEP 2: Choose the role in the Tax Office portal

On couple of occasions our clients have given the permission to our accountants to submit the personal taxes of the client (permission is given on behalf of the natural person). What you want to do is click on the “Select a represented person” button, and find your company from the drop-down menu.

Once you have done that, then you will be asked to confirm basic details of the company. If the details are correct, then click “Confirm”.

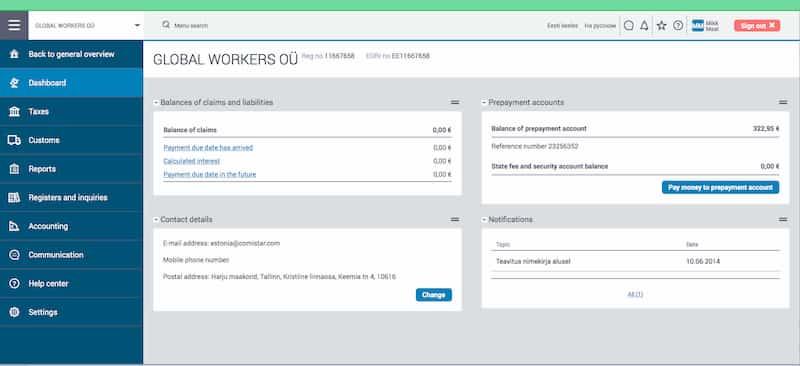

As a result, you will be directed to the following company page. Here you will see the data about the company, any money on the prepayment accounts, debts, and so forth. On the left side you can see a navigation menu. We’re getting close to adding the accountant to your company!

STEP 3: Add an accountant to your Estonian company

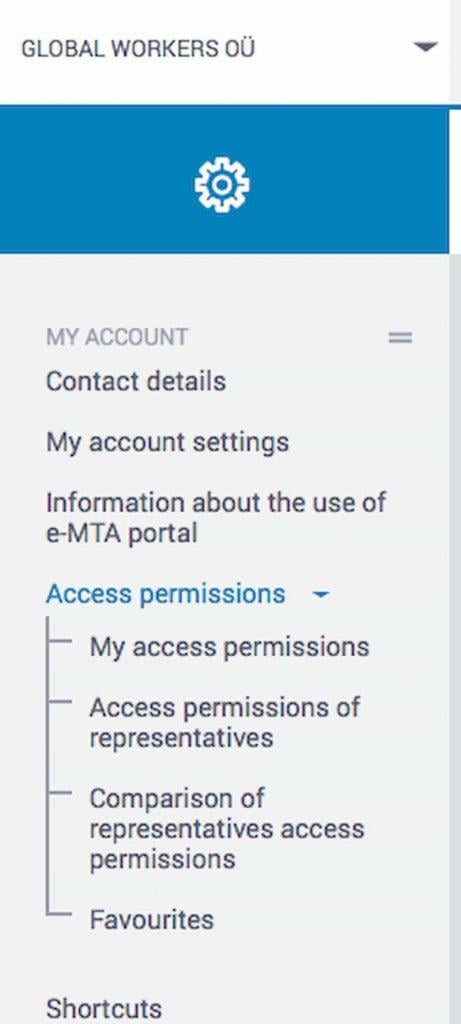

When you look at the sidebar menu, then the last item is “Settings”. By clicking on the “Settings” you will see the expanded choices that you can navigate to. One of the buttons you’ll notice is the “Access Permissions”.

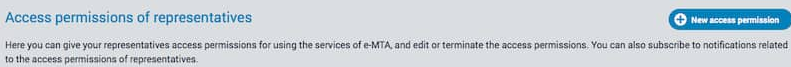

Click on the “Access permissions of representatives” button. Once you do that, you can add a permission. Click on “New access permission”.

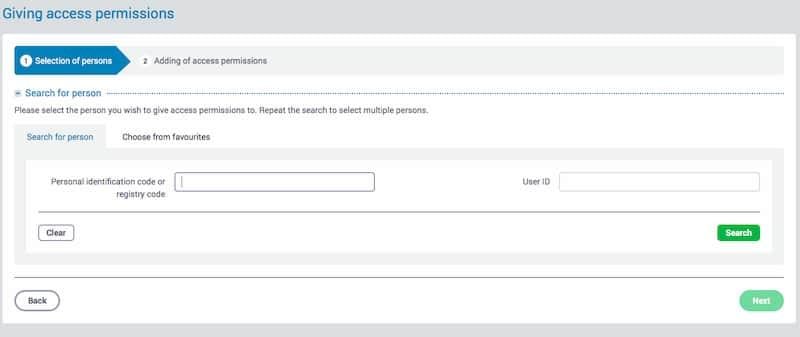

This is the moment which we described to you before – you need to have your Estonian accountant’s personal identification code or the User ID. Once you enter the data and click “Search”, the system will find the person.

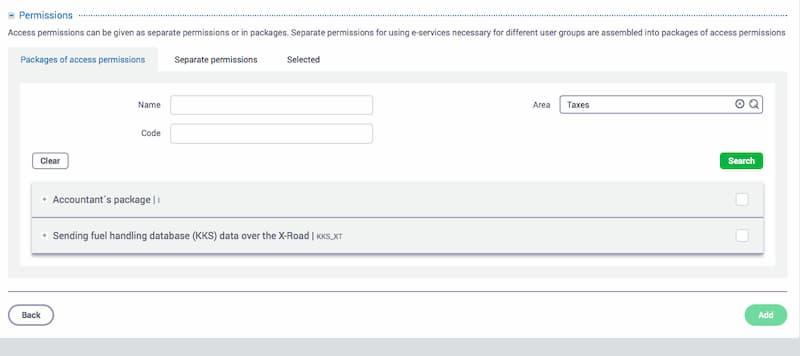

Once your Estonian accountant is found by the system, you have to choose the access package you’re going to enable for the person. Use the search after “Area” and choose “Taxes” from the given drop-down list. Click on the “Accountant’s package”.

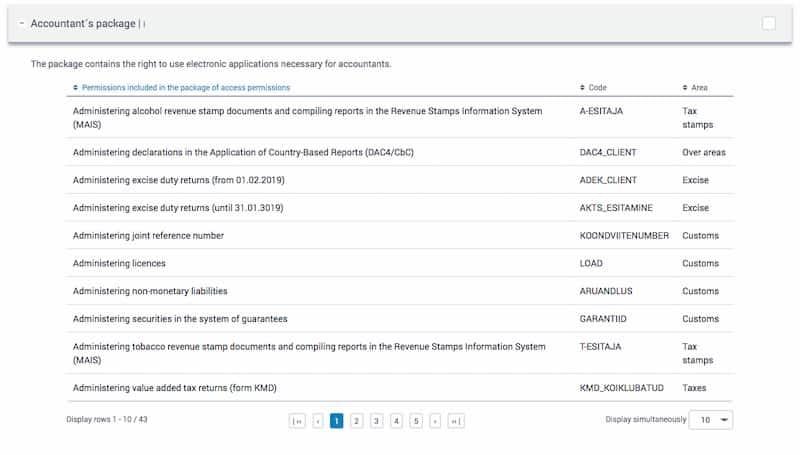

After clicking on the “Accountant’s package”you will see the rights that your Estonian accountant will have. It’s a standard package and you don’t have to change anything here.

Don’t forget to tick the box in order to add the package to your Estonian accountant access rights.

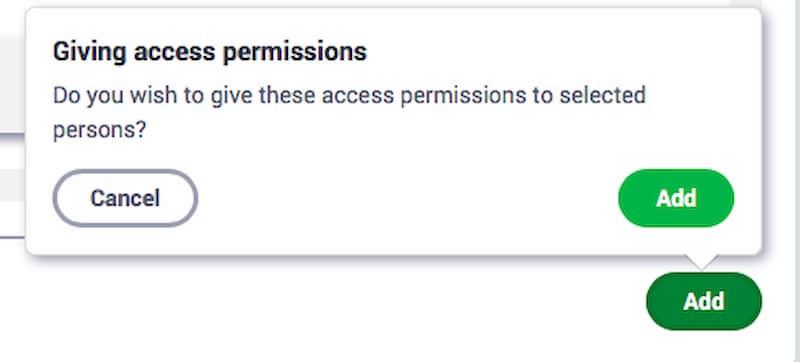

As a final step, you have to click “Add” and confirm your request. This is all that you need to do in order to add an accountant to your Estonian company. Your accountant does not need to confirm the request, and can now access your company to submit the tax declarations on behalf of your company.

Conclusion

Adding an accountant to your Estonian company is not difficult. It’s a 10-minute process, and your accountant can take care of your accounting needs and compliance going forward. If you’re looking for accounting and legal support in Estonia, don’t hesitate to contact us at hello@comistar.com. If you’re new to Estonian e-Residency, click here to read the full guide to e-Residency, and Estonian taxes tutorial.